In today’s digital age, where the world is interconnected through a vast web of networks, cyber awareness is no longer a luxury but a necessity. Our personal lives, professional responsibilities, and social functions increasingly depend on the safe and efficient use of digital technology. However, this reliance on technology has inherent risks that threaten our privacy, security, and well-being.

What is cybercrime?

Cybercrimes are sophisticated crimes committed through digital means for financial or non-financial gain. In simple language, it can be defined as any misbehaviour using a mobile phone, computer, laptop, and/or internet to promote any form of luring, cheating, or online harassment of other persons. These include financial fraud, use of offensive language, and theft of passwords or digital data.

Types of Cybercrime:

- Fraud related to social media.

- Financial or banking-related fraud.

- Cyber terrorism.

Here is some other cybercrime and it’s precaution to avoid this kind of cybercrime. This fraud is not only damage financial but emotional also, which leads to death of victims by Suicide. This fraud must have to stop and be some patience person while you use internet.

Cybercrime in the name of Telecom Regulatory Authority

The victim is contacted from a mobile number with a recorded call stating that the call is from the Telecom Regulatory Authority and that within 2 hours your mobile number will be blocked.

Victims are called by cyber fraudsters in the name of the Telecom Regulatory Authority saying that a SIM card obtained in their name, mobile number or Aadhaar is being used for anti-national activities, fraud, and harassment. For which an FIR has been registered against them and some fake FIR numbers have also been shared to scare them. Fraudsters ask the victim to dial the number 9 and then force them to join a video call via Skype, where a fake policeman in uniform allegedly reads out the details of the fake FIR along with the name, address, and other details of the complainant. In order to avoid arrest, the victim is told to be digitally arrested in his home, cuts off contact with the outside world, and demands money to settle the case and close the case. In this way cyber fraudsters are committing cybercrime.

- Do not believe callers claiming that your Aadhaar card or mobile number has been misused.

- Be careful and do not pay any money if anyone makes a financial or other demand under fear of arrest.

- Record calls of fraudsters and keep taking screenshots.

- Report to block.

- If you experience financial fraud, immediately contact the Cybercrime Police or dial 1930 or Log on to www.cybercrime.gov.in and lonch your complaint about cybercrime.

Al (Artificial Intelligence) voice cloning cybercrime

Cyber fraudsters are now using AI to clone voices. Cyber fraud is now being done using artificial intelligence under this type of fraud. With the help of Al, calling friends and relatives in a voice similar to that of loved ones/friends in need of immediate financial help in a pleading tone and the link to transfer large sums of money quickly for help is scammed.

- In case of such fraud calls, be careful, contact your friends/relatives again and verify.

- Do not pay any money in haste.

- If you get frequent calls, contact the cybercrime helpline.

Deepfake Video Call cybercrime

Al voice cybercrimes are also being scammed through video calls. In which criminals use photos, videos available on social media, by using AI and deepfake videos, they contact via video calls pretending to be familiar with someone and extort money by pretending to be someone. Many times deepfake is used to blackmail people by creating obscene pictures or videos and extorting a lot of money.

- If you get such kind of fake calls, be careful, contact your friends/relatives again and verify.

- Do not respond to video calls from unknown numbers to avoid this type of fraud.

- Be careful not to panic and pay any money.

- Contact the police immediately without any shame or hesitation.

Online Task Fraud

Earning at-home messages are sent through Telegram/Instagram/SMS/Whatsapp. Completing task (Reviews / Likes) online will get compensation as per the plan. In the beginning, a small amount of money is paid to the plan for completing tasks. It is said that adding to Then Premium/V.I.P. and that plan will give more compensation. After Premium/V.I.P. taking the plan, while completing the task, new orders are generated, and money is extorted.

- To avoid this type of fraud, do not download an application if an unknown person tells you to download an unknown application.

- Do not click on unknown suspicious links sent through SMS/e-mail. Be wary of misleading advertisements claiming high compensation for completing tasks online.

- Don’t get lured by lucrative offers on social media platforms.

Forex/Share Trading Fraud:

The victims of this type of cybercrimes are scammed by people who contact them by phone or WhatsApp message and tell them that they can get a good profit from their investment in a short time by investing in the Forex exchange market. Most of the time the victims are linked to investment groups by unknown numbers on WhatsApp, and Telegram.

- If you get any such Forex/Share Trading messages, do not respond to them.

- If an unknown number is added to a WhatsApp/Telegram group, leave the group and block the unknown number.

- Avoid downloading investment applications through links from Social media platforms like Facebook, Instagram, and WhatsApp.

Photo Moffing

This type of cybercrime involves using the victim’s photos posted on various social media platforms or otherwise and editing them to create a nasty photo to defame, blackmail, or intimidate the victim.

- Keep social media profiles private and locked.

- Do not upload your personal photos online.

- Do not accept friend requests from strangers.

- Do not allow all apps downloaded to your phone to access the phone gallery.

Video call Fraud (sextortion):

A fraudster sends you a friend request on social media from a profile with a photo of a beautiful girl. After accepting the friend request, they develop a close relationship with you and get your WhatsApp number. Then they make a video call asking you to perform indecent acts and screen recording and threatening to make your video viral on YouTube and demand money.

- Do not accept friend requests from strangers.

- If something like this happens to you, Keep your WhatsApp and social media accounts closed for some time so that they cannot contact you.

- If threatened Don’t panic and pay any money. Contact the police immediately.

- In such frauds, once the money is paid, the money is repeatedly demanded.

Fake ads:

Greedy and tempting fake advertisements are created on social media platforms in the name of different famous companies, hospitals, and restaurants. By clicking on the link provided in the advertisement or contacting the given phone number by the citizens, their bank account information is obtained, financial cybercrime is done.

- Don’t click on the fake advertisements placed on social media platforms.

- Always make any online purchases from trusted and certified websites.

Cybercrime in obtaining OTP/CVV/PIN :

In this cybercrime, they call you as they are from bank and they have a scheme to increase your credit card limits or update KYC as fast as now otherwise your account will be blocked. They create fear and give false information to you and get your bank details, credit/debit cards like CVV/PIN wipe-out your money.

- Bank employees do not call and ask for account holder’s OTP/CVV/PIN.

- KYC is not updated online. So contact the concerned office in person for this.

- Do not give OTP/CVV/PIN to anyone.

- Don’t download any application or link sent by an unknown person.

Google Customer Care Number Search Fraud:

While searching for customer care numbers online on Google, fraudsters have created a fake website similar to the real website, which contains misleading information, and phone numbers. When called on the number given without verifying the website, there is no talk or it is stated that our executive will contact you. After some time, another number calls and takes your personal/banking information into confidence and commits financial cybercrime.

- Contact the customer care number of the company from its official website.

- Save the bank/credit card and necessary customer care numbers on your mobile.

- Use the customer care number and help option provided in the application like Amazon, Swiggy, and Zomato.

Instant Loan Application Fraud:

When people in need search for loans online, they find many bogus instant loan applications online. This app offers small amounts of instant loans with less documents. While downloading the app, they ask for permission to access your mobile’s gallery, files, and contact list. As soon as they allow permission, they have your data. Then they ask you to pay the amount weekly with interest and also morph your photos and send them to people in your contact list or call and harass you.

- Do not allow permission to access contact and photo gallery while downloading any application.

- Do not click on any kind of unknown application/ link.

Crypto Currency Fraud:

Cybercriminals advertise online on social media or send messages on SMS/Whatsapp that invest in crypto currencies and get very good returns in a short period. People who contact them are shown high returns on the amount invested by opening an account in a fake crypto currency trading website or downloading an application but are not allowed to withdraw money.

- Do not respond to such messages.

- Do not download any such application.

- Do not be tempted by high returns in such applications.

Matrimonial Fraud:

A fraudster registers on matrimonial websites with a false identity, or photo, then contacts other men or women registered on the site, and develops friendship, makes the person believe, and falsely tells that a valuable gift has been sent. Then receive a call from the customs department saying to pay customs duty, or GST to release your precious gift.

- Registering on a certified and trusted matrimonial website.

- Do not share your personal information or photos.

- Do not trust an unknown internet friend and do not pay any money for a gift sent by others.

Loan Fraud:

Cybercriminals offer extortion schemes for loans by directly contacting over the phone based on the data of online inquiries made by loan seekers or by posting greedy advertisements on social media platforms for low-interest loans from different banks. Registration, Taxes, GST, etc. they grab money on charges.

- Always visit the official website or branch of the company/bank to verify the scheme.

- Verification of loan approval letter sent online.

Insurance Fraud:

A fraudster contacts a person through a mobile phone or email and tells them that your or your family member’s old insurance policy has matured or gives greedy/false information that there is a good refund in the insurance policy to get the matured amount of the insurance amount. Fraud money under security deposit, insurance penalty, a wrong policy of different insurance companies.

- Do not answer phone calls regarding bonus or maturity of insurance policy.

- Check with the nearest insurance company office.

- Make sure the policy was taken with your family members.

Job loss:

Accused by creating an online cake website or giving greedy advertisements for jobs through SMS or in newspapers, obtaining information submitted online by job aspirants, contacting them by phone or email and giving greedy false information, conducting telephonic interviews, or getting jobs through e-mail. Under different processing fees or fearing that they will lose their jobs if they do not pay the fees quickly, they cheat by extorting money.

- No company demands money for hiring.

- Don’t pay money in such haste in the lure of a job.

Lottery Fraud:

Your mobile number has been selected and you have won a huge amount of lottery money in KBC or other names by sending a message/e-mail telling you to contact on phone or click on a link to get the lottery amount. Those who contact ask for their Aadhaar card, bank account, and photo and are then tricked by telling them to pay different charges to get lottery money.

- If you receive any such message, do not respond to it.

- Do not give your personal information like Aadhaar card, bank account number, photos, or money.

OLX Fraud:

When citizens advertise their items for sale on OLX, often a stranger pretends to be in the army and insists on making an advance payment through a wallet to buy the item and sends a QR code to be scanned, when the victim scans the QR code. Instead of receiving money, the money keeps going out of his account.

- Never scan a QR code or enter a UPI PIN/Password to get paid.

- Always insist on meeting the seller/buyer in person.

- Remember that identifying as an Army man on social media platforms is not necessarily in the Army.

SIM SWAPING FRAUD:

Your personal information is obtained by criminals by sending links via phishing, vishing, or SMS. Then they block your sim with the service provider. Go to the service provider in person and get a new SIM card. Money is then siphoned off from the bank account linked to your mobile.

- Do not give your personal information or documents to strangers online for any reason.

- If the phone network goes down for a few hours, immediately contact your mobile service provider and verify that a new SIM has not been assigned to anyone.

Income Tax Refund Fraud:

Fake messages are sent by criminals that your income tax refund is in process so click on the given link to get refund. By clicking on the link, they get your bank account and personal information and commit financial cybercrime fraud.

- Do not respond to such messages. Do not click on the given link.

- Do not give your personal and bank details if the link is clicked.

- You verify that you have filed a return or taken action for a refund.

Online Gaming Fraud:

Due to the increase in the prevalence of online gaming, cybercriminals create fake websites similar to popular game websites and get your bank account, credit card number, and other online account log-in information and sell them in the online gray market. In many cases, information is gained through chatting and building friendships. Gaming accounts that have a large paying audience are targeted and hacked. Money fraud is done by giving fake offers in online games.

- Never click any link sent by e-mail or SMS to download the game.

- Don’t chat with strangers while playing games Block and report any harassers.

- Do not make any financial transactions outside of the game if someone offers a cheap offer for an online game.

- Keep two-factor authentication activated in your gaming account.

Friendship Club Fraud:

Advertisements are given in newspapers or sent by SMS to join friendship clubs to make friends with girls and earn money by spending time with them. When the aspirants contact, they are cheated by giving different reasons like for registration, for meeting with the girl, for booking the place.

- Do not contact by reading such advertisements in newspapers and do not respond to any such SMS.

- Do not pay any money for registration on dating websites and friendship clubs.

Fraud without providing OTP: (Card Cloning):

Skimmers are installed on ATMs/restaurants/petrol pumps and also in POS machines at many places. Who obtains your data by cloning your debit card/credit card and after seeing the PIN entered by you, creates a debit card/credit card with a schemer machine and commits financial fraud.

- Checking that any skimmer is installed in the ATMs and not allowing anyone else to stand in the ATM center.

- Order POS machine at restaurant/petrol pump and give check card.

Cyberbullying/remailing:

Cyberbullying is the sending of messages, videos, photos by a person to any other person with the purpose of threatening, intimidating, humiliating or humiliating, mocking, using electronic messaging.

- Do not accept friend requests from strangers.

- Do not share your personal information on online social media platforms.

- Think before posting anything online.

- If you are a victim of cyber bullying, immediately inform the parents and contact the nearest police station.

- Share passwords on social media platforms even with your very personal friends.

Cyber stalking

Cyber stalking is when a person stalks any person using electronic means, knows their daily activities on social media, collects their personal information, and harasses or threatens them through email, social media, chatrooms, and instant messaging is called cyber stalking.

- By uploading all your activity on social media, an unknown person can monitor all your activity and abuse it.

- Keep social media profiles private and locked.

- Don’t upload your every activity on social media.

- Avoid using public wifi.

Identity Theft:

Your personal information like address, phone number, e-mail address, login ID, password, credit card information, bank account number, etc. are obtained by cybercriminals through social engineering, sending links through e-mail, and SMS for illegal financial gain. Used is called identity theft.

- Keep your passwords at least eight characters long, with one capital letter, one small letter, one numeric number, and one symbol, and change them regularly.

- Do not click on links sent by unknown person through e-mail, or SMS.

- Keep security software on your device and keep all applications updated.

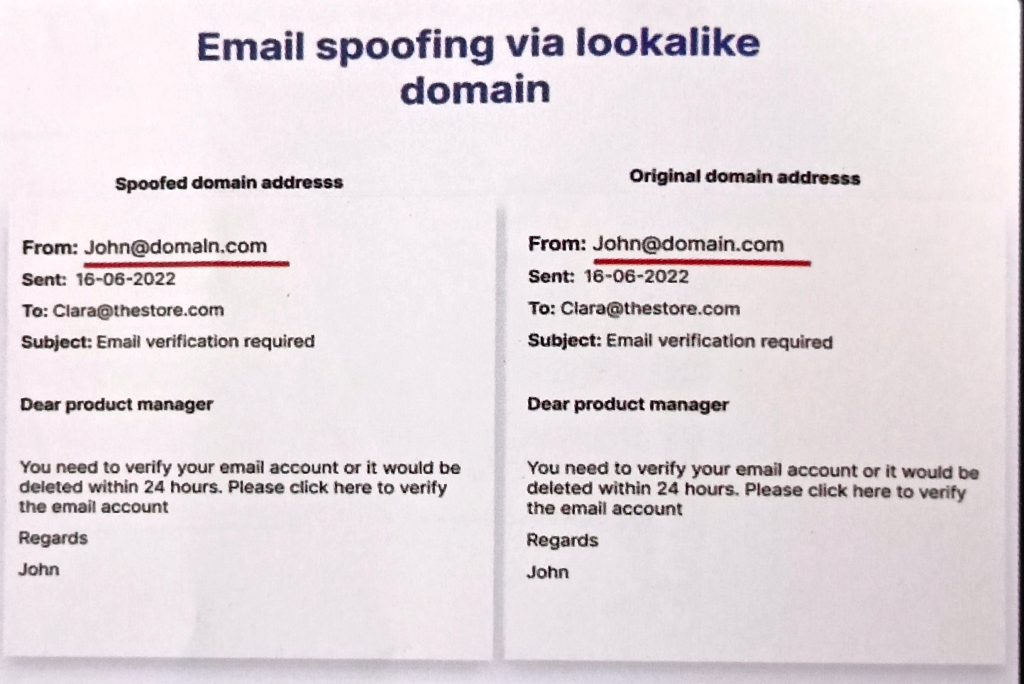

Email Spoofing Fraud:

When e-mails are used to quickly share important information/work orders/payment details etc., cyber crooks create exact replicas of email IDs or use similar words to spoof emails. Fraudsters try to profit by changing the delivery method for the goods or they can also change the bank account details where the money is to be deposited. As part of the cybercrime, the accused also tries to divert funds or demand money under different pretexts.

- Email spoofing via lookalike domain

- Do not click on unknown suspicious links sent by e-mail.

- Always check spelling carefully in e-mail addresses and website URLs.

- Increase your email security by activating spam filters.

Ransomware cybercrime:

Ransomware is a malicious software (malware). By clicking on an e-mail or link sent by an unknown person, this malware encrypts the files and data on your computer so that you cannot access the files. The e-mail sender then asks for a ransom to decrypt the files and is usually asked to pay in bitcoins/dollars.

- Disconnect the internet when not using the computer.

- Back-up data regularly.

- Don’t click on links or e-mails from unknown sources.

- Do not pay any ransom to decrypt files.

Beware of fraud and educate others also by sharing this information, sometime your presence of mind will save you and your money. So stay alert and aware of this fraud. Don’t be greedy and have some patience.

One Comment